Using Xero to automate your bookkeeping

Xero accounting software helps you to stay on top of your bookkeeping, keeps your financial data secure and lets you work from anywhere. If you are using spreadsheets or keeping physical copies of your receipts, invoices, and bank statements, now is the time to set up on Xero.

You don’t need to wait until your financial year-end, or if you’re currently using different software, you can also complete a Xero conversion at any time.

In this guide, we show you the benefits of Xero bookkeeping software and explain why you should move to cloud accounting sooner rather than later.

Benefits of Xero accounting software

-

Available anywhere with desktop and mobile app

The great thing about having your accounts online is that they’re available anywhere you are. Information is easily retrieved through your computer or mobile app.

-

User-friendly interface

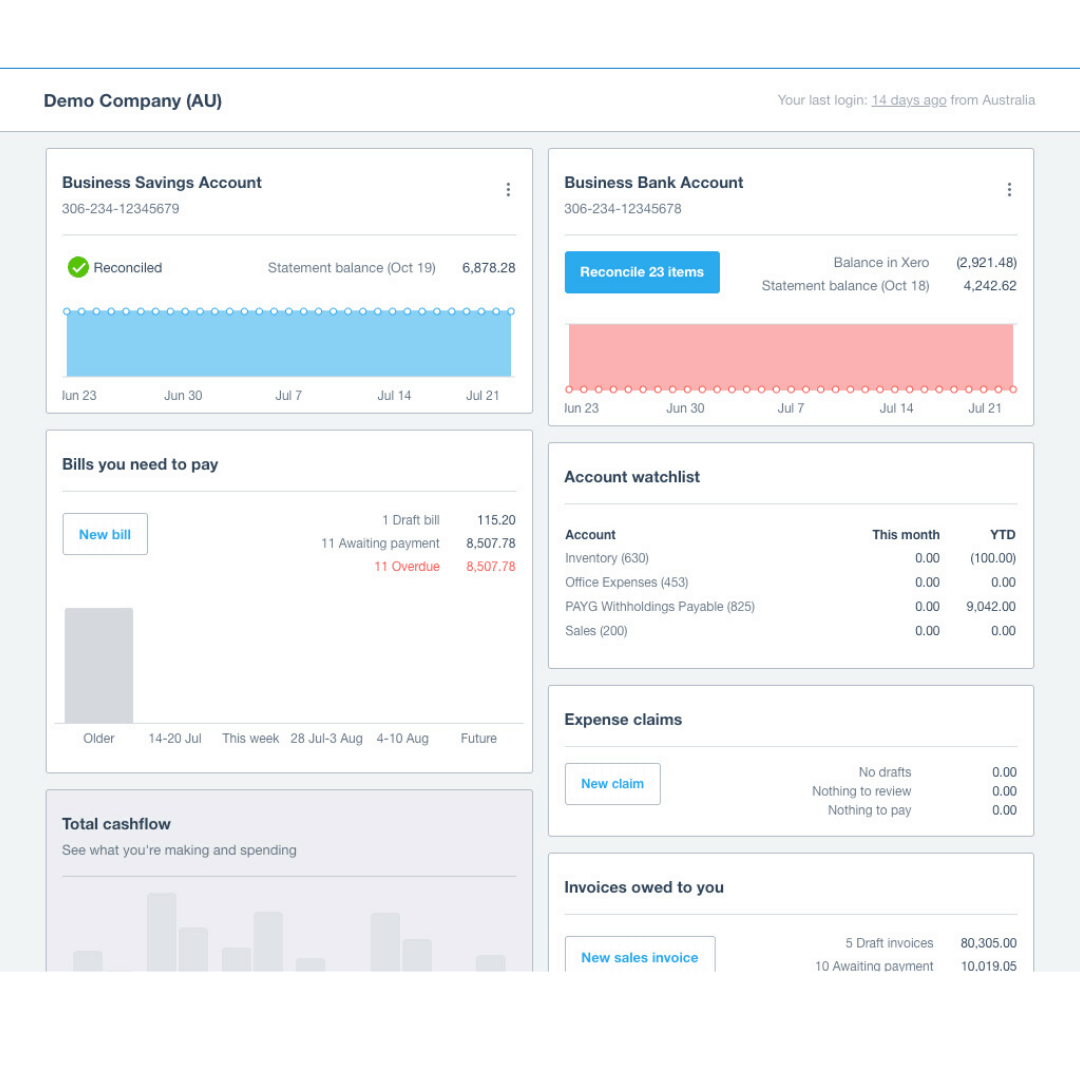

Xero has easy-to-use, customisable dashboards so you only need to see what is relevant to your key metrics.

-

Time-saving functions

Another Xero benefit is that it saves you time. Monotonous procedures, such as bank reconciliation, invoicing, and categorising expenses, are easy when done on Xero.

-

Over 800+ integrations with other apps

Streamline your financial function and have a central location for your cash flow management and forecasts.

-

Accurate, real-time information

You can link your bank account, send invoices, and pay bills from Xero so you always have up-to-date information on your cash flow situation.

-

Make more informed financial decisions

With access to clear and accurate financial information on your business, you'll be able to make better business decisions and plan more effectively for the future.

Get paid faster with Xero

Xero carried out a study on their clients and compared small businesses that used Xero software to those that didn’t.

- Australia/New Zealand customers that used their payment platform got paid an average of 12 days faster compared to ones that didn’t

- In the USA, small businesses were paid 25 days faster when using Xero software

- In the UK, Xero customers got paid an average of 15 days faster than non-Xero users.

Xero connects to your bank accounts

-

Connect to your bank

Upload bank statements or connect Xero directly to your bank account so you can get live bank feeds on your Xero account.

-

Quick and easy bank reconciliation

This feature allows you to match bank transactions to receipts and invoices already on your Xero account with the click of a button.

-

Set up bank rules

You can set up bank rules for certain transactions. This works excellently for wages. Set up a rule whereby every time a transaction appears with your employee’s name, it is posted to it to a wages folder.

-

Mark over/underpayments

Getting paid in two parts? Xero is very straightforward when it comes to allocating two payments to one invoice.

-

Multi-currency reconciliation

If you trade internationally, Xero allows you to use over 160 currencies and you can benefit from automatic currency conversions.

-

Set up a direct feed from Stripe, TransferWise or PayPal

See and manage all your payments in one, easy-to-use platform. You can use these as payment services so you can get paid faster!

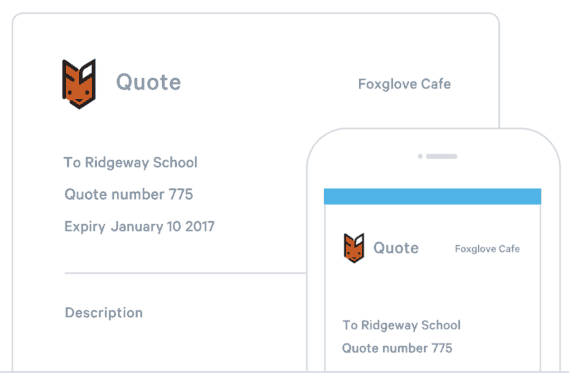

Send beautiful sales invoices to your clients

Custom templates for invoices

No need to use an external invoice creator, do it beautifully inside the Xero platform.

Set up automatic reminders to customers

Xero helps you manage your credit control by reminding your clients to pay your invoice before and after the pay due date.

Email templates

Save time by setting up email templates so you can send them quicker to get paid quicker.

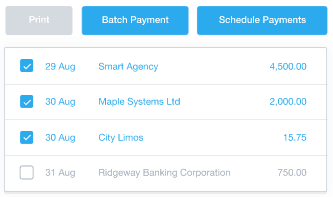

Expertly manage your purchase invoices

Ability to upload in bulk

If you use receipt tracking software already, it's likely to integrate with Xero. Or if you're working with spreadsheets there is a template in Xero so you can upload it directly into the software quickly and easily.

Email syncing via Xero software using HubDoc

You can also sync Hubdoc up to your email address and it will automatically look for supplier invoices and upload to Xero.

Simple to amend mistakes

Find & recode

This is a great tool in Xero that we don't see in other software. It's a simple yet effective tool that allows you to find and replace any mistakes.

History & notes

We also like this digital footprint feature in Xero. You can see what changes were made, who made them and when.

Use the tracking categories to enhance your business decision-making

This is a great feature that allows you to split your invoices. Your sales and bills can be categorised into different reports so it’s perfect for the metrics that are important to you. Another one of the benefits of Xero is the dashboard that lets you see your business at a glance.

About Xero accounting software

Xero is the global leader in online accounting software that connects small businesses to their advisors and accountants. It is ranked #1 by Forbes as one of the world’s most innovative growth companies.

Its user-friendly interface, easy-to-use system, and highly accessible support content make Xero the best software for accounting and bookkeeping for Startups and SMEs in Ireland.

We are a Xero Platinum Partner, all our accounting teams are Xero certified advisors, and we have the skills and expertise in-house to make automating your bookkeeping easy and efficient.

Xero success story

“One of the main reasons for switching to Accountant Online was their Xero Gold Partner status. It was so simple to give them secure access to my accounts. Within a matter of days, the team had done their magic. My accounts were cleaned up, categorised, and consolidated.

Now, all my bank feeds are pulled into Xero automatically. I use the Xero app to submit add expenses and match up bank transactions. It takes so much guesswork and anxiety out of day-to-day accounting as well as VAT and annual returns. It’s a credit to the team in Accountant Online who are so efficient, professional, and friendly. I’d like to thank all of them for making my life so much easier.”

How we help: Leverage the Xero benefits in your business

As a business owner, it’s important that you can have confidence in your numbers. Not only does Xero bookkeeping save you valuable time and increase accuracy, but it will also help you to stay in control of your cash flow management and you will be able to make decisions based on accurate financial information.

Our professional team of bookkeepers and Xero Certified Advisors are here to assist you in streamlining your business operations and we offer Xero Conversion & Training services to ensure a smooth transition to Xero.

Carl is the Cloud Relationships Manager at Accountant Online, and he works with a team of payroll, VAT and bookkeeping professionals to look after the day-to-day finances of growing companies. He works closely with founders, managers, and other key staff to help modernise and upgrade financial information with cloud bookkeeping and software.