There are two main reasons you might choose to give away equity in your start-up:

- To entice top talent or a notable board member to join your Startup

- To raise funds

Regardless of why you are considering giving up equity, there are some things you should consider before deciding to take this route.

In this blog, we have outlined some top tips to keep in mind when deciding whether to give away equity in your business.

Don’t give away all your equity

It is not uncommon for first-time founders to be left with only a small percentage of their company, according to investor Carey Smith, founder of Big Ass Fans and Unorthodox Ventures, in a feature he wrote for Inc.

“At our firm, we see this problem time and again. In the past year, we talked with nearly 40 startups whose founders no longer have a controlling interest in their companies. More than half own 20 percent or less. Because of their inexperience, they’d sliced out equity as if it were imaginary cake at a child’s pretend party.

We met one poor guy who, unlike that gnarled old giving tree, barely had even a stump left to sit on. By the time he met with us, he retained only 1.6 percent of his startup. You want to help them, but often it’s too late.”

Decide how to distribute your equity beforehand

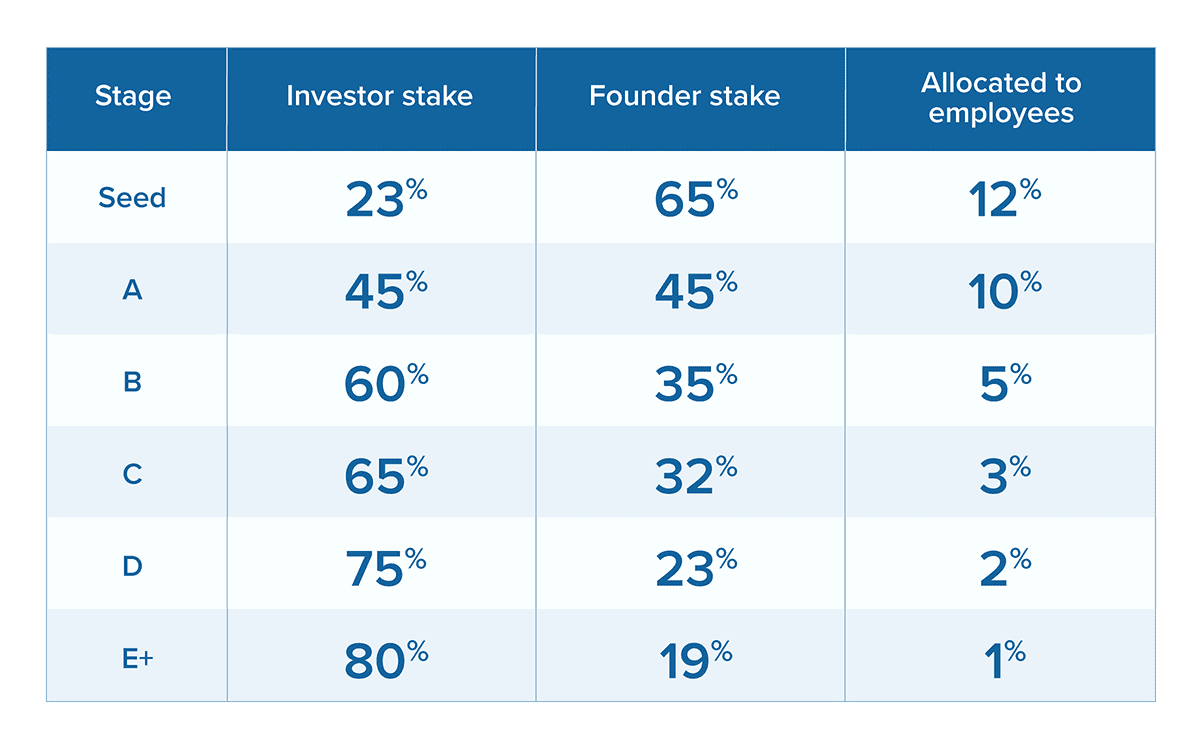

The question of how soon and how much equity you should give away is like asking ‘how long is a piece of string’, but this handy table, care of Gust.com can give you a good idea.

Consider your legal obligations

Of course, giving away equity in your company requires some form of legal assistance to make sure that everything is above board, and you are getting the best return for your equity. You should get legal advice and be aware of your legal obligations before you make the decision to sell equity.

SeedLegals is a one-stop platform for all the legal resources you need to get funded and grow your business. They can help you with founder agreement and, share option schemes for your team. They can also help you create your first cap table and other legal documentation consistent with what investors want to see.

“We’re doing industry-leading legals for specific start-ups across the UK, France, and Ireland. 35,000 start-ups have used the platform therefore, we know what’s right” says Michael McDowell,

Country Manager – Ireland, SeedLegals.

Do you need to offer top talent skin in the game?

When you start trying to hire employees for your Startup, you might find that expectations on salaries differ, and hiring top talent might be more than you can afford. This is where the need may arise for you to offer those joining your team ‘skin in the game’.

There are 2 main benefits to offering top talent equity in your business:

- You may be able to afford to hire talent you wouldn’t be able to afford otherwise

- Giving employees ownership in your business will make them more invested in doing their job well because if the Startup does well, they do well

However, Michael McDowell of Seedlegals warns against doing this too often.

“You have to be so very careful. If you start giving away a percent here and a percent there, what you then find is by the time you go out and directly raise investment and ask people to give the money for the equity, they’ll look at your cap table and start asking questions of ‘who’s that with that 1% or that 5%?” Then becomes complicated,” warns Michael.

Consider keeping some equity for future funding

Wallace Corporate Counsel is a boutique law firm. The investments team focuses on advising early-stage high-growth companies or investors in venture capital on investment transactions. They also deal with the day-to-day legal needs of Startups and investors.

“Equity is not something start-ups give away unless they have to give it away,” explains Michael Bambrick, Partner at Wallace Corporate Counsel “It’s potentially the most valuable thing that they own.”

“Equity is provided in exchange for something of value so it depends on what the company needs, and when it needs it,” he adds.

It really pays to speak to an advisor before you consider any transaction that will mean giving up equity in your company. If you are planning on growing your company, you will need something to leverage in every funding round.

Consider equity crowdfunding

Spark Crowdfunding is an equity crowdfunding platform that helps Startups and scale-ups exchange equity for funding. However, Spark CEO, Chris Burge suggests exploring other options before deciding to sell equity in your company.

“The longer you can delay it the more value you can get into your business, therefore the smaller amount of equity you’ll give away, which is, of course, advantageous for you as the founder, and also somewhat de-risks it for the investor,” says Chris.

If you are looking to delay giving away any morsel of your company, then you should look at grant options through your Local Enterprise Office or Enterprise Ireland before you go down the equity funding route.

In summary...

There is no exact answer to the question of ‘when is the best time to give away equity in your business.” There is only the right time for you, as the founder, as you grow your business.

Smaller companies may never need to sell equity as they can get by on bootstrapping and bank loans but Startups looking to scale may have to offer equity to get to the next step.

Larissa is a Fellow Chartered Accountant (FCA) and is the CEO of Accountant Online, which specialises in company formation, company secretarial, annual accounting services, bookkeeping, tax, and payroll services for micro and small companies in Ireland and the UK.