Who needs a business bank account?

If you’ve recently started a business in Ireland, setting up a business bank account is the next step. Many different banking options are available in Ireland, and we can help compare business bank accounts.

Some banks have lots of experience helping Startups and charge no bank fees for the first year in business, which can help minimise your costs in your early days.

This guide provides you with an overview of different banks available for business owners in Ireland, but please be sure to consult with the bank directly for any specific advice.

How to choose the right business bank account?

Questions to ask your bank

Q: How much do they charge in fees?

This is a very important question for Startups in Ireland. New businesses are just starting out and want to minimise expenses. If you have to pay substantial bank fees for each transaction it may be worth shopping around more to find the best value.

Q: Do you have specialised support for Startups?

A bank plays a huge role in any business. It provides your accountant with the necessary information to produce your financial statements. It's also the central location of the money in your business. Do you want your bank to support you on your Startup journey? Do they offer any support for you as a new business?

Q: What is the application process like?

A long application process can be tedious. If you have clients waiting to pay you or invoices you need to pay, you want an application process that is as short as possible. Ask whether they offer a completely remote account set up or if an in-person meeting with one of the directors will be required.

Q: Are there any restrictions?

This may not be too important to a new business, but you want to ensure that your bank is able to handle your company's growth. How much does the bank let you transfer per day? How many bank cards/debit cards/authorised signatories can you have on the account?

Q: Do you offer direct debit mandates?

This can be vital for paying bills. It removes the admin costs of making bank transfers every time you pay a bill. Is this something your business needs?

Q: Do you have a banking app?

Do you want to have access to your bank through your mobile? What is their mobile site/website like? Do they offer reports of your spending habits or is this something you need? Considering these questions will help you make an informed decision on the best business bank account for your business.

What you need to open a business bank account

-

Photo ID and proof of address from the account holder or holders

Acceptable forms for ID can include current passport or drivers licence and acceptable proof of address documents can include a utility bills, some tax documents, and mortgage documents.

-

Certificate of Incorporation and a copy of your company's consitution (if you are a Limited Company)

-

Proof that your company is registered with the Registration of Beneficial Ownership (RBO)

Company bank accounts in Ireland

Bank of Ireland

Bank of Ireland offers a Startup package specifically designed for businesses that have started within the last three years.

Transaction and maintenance fees

Startups enjoy a waiver on transaction, maintenance, and overdraft facility fees for the first 24 months.

Free tools and guides

Bank of Ireland provides a range of free tools and guides to support new businesses.

Deposit options

Business accounts have a various deposit options, including instant access to business notice accounts and fixed-term deposits.

Access to Bank Of Ireland 365

Customers have access to Bank of Ireland 365 online, allowing them to make online payments of up to €20,000 per day and access their account whenever needed.

Subscription to Business Online (BOL)

Bank of Ireland's dedicated online banking service for businesses is called Business Online (BOL). New business customers receive a waiver on subscription fees for this service for two years.

Facilities

Bank of Ireland's Workbench program provides facilities for startups and entrepreneurs, including free Wi-Fi, hot desks, interactive screens, and events. Workbenches are currently available in Dublin, Kilkenny, Limerick, Cork, Kerry, Waterford, Donegal, and Galway.

How do I open a business bank account with Bank Of Ireland?

- Determine your business type: Bank of Ireland allows Sole Traders and Limited Companies to apply for and set up their business accounts online. However, partnerships and other business customers need to meet with a Bank of Ireland business advisor.

- Online application for Sole Traders and Limited Companies: You can complete the application process online without visiting a branch.

- Meeting arrangement for partnerships and other business types: For partnerships and other business types, you’ll need to schedule a meeting with a Bank of Ireland business advisor. This can be done online.

Permanent TSB business banking

Permanent TSB's business banking services cater more towards Sole Trader bank accounts and established businesses rather than Startups so it doesn't have a tailored package for new businesses.

No transaction fees within Europe

Permanent TSB provides businesses with the benefit of conducting transactions within Europe without incurring any fees. This includes countries outside the Eurozone as well.

Bulk Payments

Businesses have the option to streamline their payment processes by uploading a payment file for wages or suppliers. This eliminates the need to set up individual transactions every month.

Business Visa debit card

With a Visa Business Debit Card, you can conveniently deposit cash and cheques, as well as withdraw up to €1,500 per day from a branch.

Dedicated Business Banking Team

Permanent TSB has a dedicated support team available for businesses. You can reach out to them in-branch or over the phone to get assistance with any queries or concerns.

Face-to-face banking

If you prefer face-to-face interactions, Permanent TSB offers over 70 branches across Ireland, giving you the option to visit a branch for your banking needs.

How do I open an account with Permanent TSB?

- Make an appointment: Contact your local Permanent TSB branch to schedule an appointment. You can reach them at 0818 200 100 or +353 1 215 1363. This ensures that a representative will be available to assist you with the account opening process.

- Gather required documents: Prior to your appointment, it’s important to gather the necessary documents to open your bank account. While specific requirements may vary, common documents typically include:

- Complete necessary paperwork: Fill out the account opening forms provided by the bank. These forms typically include personal information, business details, and terms and conditions for the account.

- Initial deposit: Depending on the type of account you are opening, you may be required to make an initial deposit.

AIB Startup package

The AIB Business Startup Package is tailored for Startup businesses that have been operating for less than three years and are opening their first AIB Business Startup Current Account.

No transaction or maintenance fees

Enjoy two years without any account maintenance or transaction fees, helping you save on banking costs during the initial stages of your business.

Discount off cash handling fees

Receive up to €100 discount off quarterly cash handling fees, making it more cost-effective for your business to handle cash transactions.

AIB's merchant services

Access AIB's Merchant Services, which enable you to accept payments in-store, online, or over the phone. Find a payment solution that suits your business needs and streamline your transactions.

Online service for small businesses

AIB offers an online service specifically designed for small businesses, providing convenient access to essential banking features. Additionally, they provide an online banking service tailored for medium to large businesses.

Brexit Support

AIB extends Brexit support to all their business banking clients. You can benefit from specialised calls with Brexit advisors who can provide guidance and assistance on navigating the challenges and opportunities associated with Brexit.

Business support for women entrepreneurs

AIB organises business masterclasses specifically for women entrepreneurs. These events are best suited for business owners who have been trading for more than 18 months, offering valuable insights and support for their growth and success.

How do I open a business bank account with AIB?

- Meeting with AIB in-branch: The director and at least one authorised person responsible for signing transactions on behalf of the company need to schedule a meeting with AIB at a branch.

- Print and sign necessary documents: Before the meeting, ensure you have printed and signed the document outlining the chosen package’s terms and conditions. It is required for two directors or one director and one company secretary to sign these forms.

- Additional requirements for non-residents: If you are a non-resident director, be aware that you may have additional requirements.

If you have a full-time job while running your business, consider your schedule and availability for in-person meetings and branch visits. Online-only banks or those with extended hours may provide more convenience.

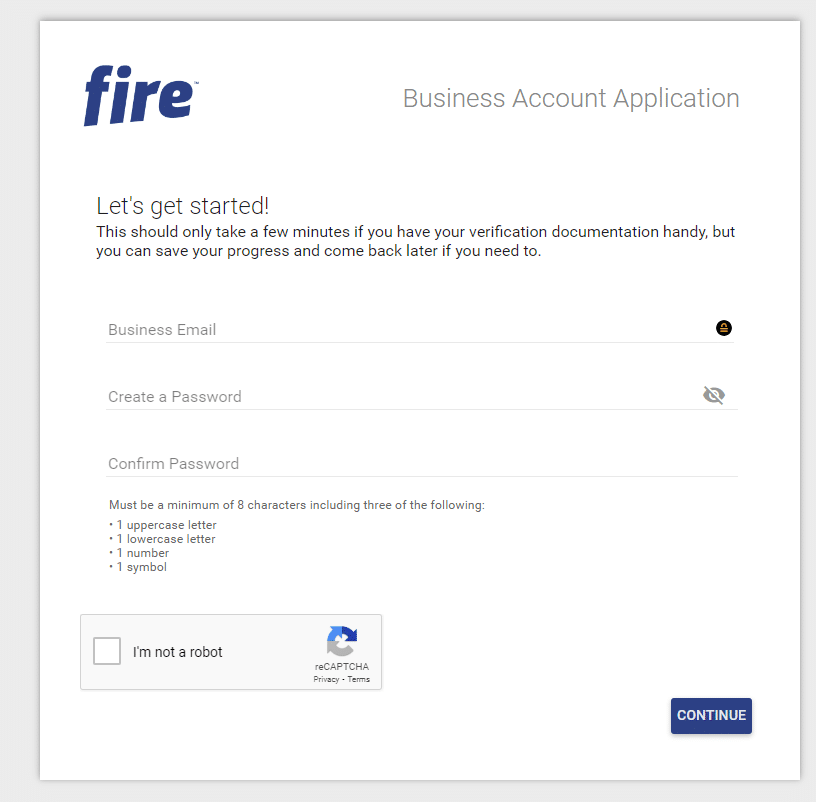

Fire business account

The Fire business account offers a digital banking solution for businesses in Britain and Ireland, particularly catering to e-commerce businesses.

Multiple users with multiple MasterCard debit cards

Set up multiple users with different access levels and order multiple MasterCard debit cards linked to both a Sterling and a Euro account. This enables easy and efficient money transfers between accounts within your team.

Real-time features

Stay informed about your account activity with instant notifications for payments received, card usage, and other account transactions. Conduct real-time foreign exchange (FX) transfers between your accounts and view the fees before executing a transaction, ensuring transparency and awareness of charges.

Sterling and Euro accounts

Fire provides both Sterling and Euro accounts, allowing seamless bank transfers in and out of your business accounts. You can add new accounts immediately and in real-time to meet your changing needs.

Account integration

Integrate your Fire accounts with your existing systems using the Fire Business API. This enables automation of reconciliation processes and provides real-time updates on your accounts, streamlining your financial management.

Easy for accounting

Fire is compatible with major accounting software packages such as Xero, QuickBooks, and Sage One. This simplifies the process of managing your finances, ensuring smooth integration with your preferred accounting tools.

No setup costs

Fire does not impose any setup costs or ongoing monthly maintenance fees, providing a cost-effective banking solution for your business.

How do I open an account with Fire.com?

- Online Account Opening: The Fire business account can be opened entirely online, making it a convenient option for busy entrepreneurs.

- Fast account setup: Fire.com strives to provide a swift account setup experience. In most cases, you can expect your account to be opened within 24 hours, allowing you to start managing your business finances promptly.

- Non-Irish residents: If you are a non-Irish resident, you can still open an account with Fire.com under specific circumstances. You can open an account if your company is incorporated in Ireland or the UK.

N26 bank account

N26 offers a low-cost, easy to use online banking service aimed at Sole Traders and freelancers.

Tag transactions

N26 allows its users to tag transactions associated with one project. This should help make it easier to split personal from business transactions for auditing and tax reporting purposes.

Remote banking

All banking services can be accessed through a smartphone. You'll get push notifications to your phone anytime a transaction comes in or out of your account and can access insights on your spending in-app

Business MasterCard

Get a business Mastercard which includes cashback on transactions of 0.01%. However, you should note that, unlike cashback, cash deposits can only be made at N26 locations, in Germany

Budget for taxes

N26 allows you to create up to 10 ``spaces`` where you can easily set aside money for different projects or to pay your tax bill

European citizens only

You need to be a citizen in a European country where N26 are operating. This means that due to Brexit, N26 has closed all UK accounts. You should take this into consideration when choosing what bank account to open.

Savings

Offer interest on savings accounts through the N26 partner bank - interest is paid every 3 months and funds can be accessed in just 2 days

How do I open an account with N26?

- N26 business banking options: N26 offers three business banking options to choose from: Business Standard (free), Business Smart (€4.90 per month), and Business You (€9.90 per month). Consider the features and benefits of each option to determine which one best suits your business needs.Online account setup: With N26, you can set up your business account entirely online. The process is designed to be quick and efficient, taking just 8 minutes of your time.

- Customer support: If you require assistance during the account setup process or have questions, N26’s support team is available in multiple languages, including English, French, German, Italian, and Spanish.

Revolut business account

A Revolut business account offers a fully digital account in over 30 currencies. It is a great option for companies who need to make and receive payments in multiple currencies.

Revolut Connect

Revolut allows you to sync transactions to accounting platforms such as Xero and FreeAgent, saving you admin time.

Prepaid business cards

You can give each of your employees prepaid business cards (physical or virtual) that are connected to your companies main account. Revolut allows you to track and set limits for your teams spending and approve expenses, all in real-time.

Discounts and perks

Revolut has several 'Business Partners', such as Apple and Google Adwords, who offer discounts for Revolut Business Account Holders.

Send Invoices

Create and send professional looking invoices with Revolut's web or mobile app in minutes.

Open API

Revolut's open API allows you to merge your business account with your existing business software and processes. This will allow you to automate all of your business processes, including making and scheduling payments.

Multi-currency accounts

Hold, receive and exchange up to 24 currencies using the inter-bank exchange rate, with no added fees from Revolut. You can also have business cards for multiple currencies. Revolut have also updated to allow for direct debits in Euro.

Revolut Pro for business owners

How do I open an account with Revolut?

- Online application: This convenient process allows you to provide the necessary information and documents digitally.

- Application review: Revolut will review and process your application. In many cases, account approval can be granted within just a few hours. However, during periods of high demand, it may take up to a week to receive a response.

- ID verification: This involves providing the required identification documents to establish your identity as a business owner.

- Business information: You will be asked to provide information about your business, such as its nature and activities.

Wise

Formerly TransferWise

Free to receive money in EUR, USD, GBP, PLN, AUD & NZD

You can get your own UK, Eurozone, Australian, New Zealand, and US bank details for free without a local address.

Integrates with Xero

Wise allows you to sync your activity for over 40 currencies to Xero, saving you admin time.

Open API

You can use Wise's API to automate and generate payments, get real-time notifications on platforms like Slack, simplify expense reporting and more.

Batch payments

Handle up to 1,000 payments with a click of a button. No need to manually payout to all your vendors or employees.

Free debit Mastercard

If you want to spend a currency you don’t have in your account, there’s a transparent fee. There’s also a charge for withdrawing cash over a certain amount.

Wise app

View history, order statements, check or change your PIN, freeze your card, get instant notifications when sending, spending or receiving money.

How do I open an account with Wise?

- Online registration: Wise’s bank registration process is completed entirely online, allowing you to set up your account from anywhere. According to their website, the verification process typically takes between 2 to 3 days to verify your business information.

- Account setup fee: There is a one-time fee of €50. This fee covers the initial setup and ensures you gain access to Wise’s comprehensive range of features and services.

- Wise debit card: As part of your business account, you have the option to order a Wise debit card. This card enables you to easily access and manage your funds. The cost for obtaining a Wise debit card is €4, providing you with a convenient payment tool for your business transactions.

Do I really need a business bank account?

Sole Traders and Limited Companies are under no legal obligation to set up a bank account for their business. However, it is considered best practice to have a separate account for your business transactions for a variety of reasons.

A business bank account can help you to separate your business accounts from your personal banking, ensuring that your bookkeeping is clear and accurate. This makes it easier to keep up with the relevant reports needed for Irish revenue and makes budgeting for your business a less daunting process.

A separate business account is also essential for vital tasks such as paying bills, receiving payments from customers, and paying your employees and yourself.

If you need help please talk to our Client Services Team today.

What do EEA nationals need when setting up a business bank account in Ireland?

Online banks such as N26, Fire and Revolut do the entire setup process online, which can be the best bank for ecommerce and online businesses.

For AIB, Permanent TSB, and Ulster Bank, you will have to meet the bank at least once in person to finalise setting up your account. As mentioned, The Bank of Ireland is the only company with a process for foreign business owners.

In terms of documentation, you will need a certified copy of your ID and proof of address if you can’t provide the original. A bank or an official institution in your country can usually do this for you. However, we do recommend contacting an advisor at your selected bank directly to verify who can confirm the authenticity of copied documents.

Frequently Asked Questions

What documents do you need to open a business bank account in Ireland?

1) Photo ID and proof of address from the account holder

2) Certificate of Incorporation and a copy of your company’s consitution (if you are a Limited Company)

3) Proof that your company is registered with the Registration of Beneficial Ownership (RBO)

How long does it typically take to open a business bank account?

The timeline for opening a business bank account can vary based on multiple factors, such as the chosen bank, business structure complexity, and document preparedness. In general, the process can take anywhere from a few days to a few weeks.

What is the best bank account in Ireland for businesses?

We recommend that you choose a business bank account that suits your business needs. Many of our clients opt for the same bank where they hold personal accounts, such as Bank of Ireland or AIB. This offers familiarity, convenience, and potential benefits of bundling personal and business banking services. Some prefer online banks like Revolut and Fire as they offer convenience, quick setup, and often competitive pricing. Ultimately, the ideal business bank account will depend on your unique business needs and preferences.

Larissa is a Fellow Chartered Accountant (FCA) and is the CEO of Accountant Online, which specialises in company formation, company secretarial, annual accounting services, bookkeeping, tax, and payroll services for micro and small companies in Ireland and the UK.