Are you in the process of hiring staff for your business? Are you a Sole Trader hiring employees or a director paying yourself a salary?

As a business owner, you need to register as an employer before you hire staff to take care of certain aspects of your business.

If you are a Sole Trader you don’t take a salary but you can become an employer and hire staff. You can pay yourself a salary if you are a director of a Limited Company, but you need to register the company as an employer.

But, paying yourself as a business owner is distinct from how you pay your employees. Your own remuneration can be influenced by various factors and business structures.

This guide will take you through the Irish payroll system and explain some of the processes around paying staff in Ireland.

This distinction between “contract of service” and “contract for services” explains the difference between hiring staff in-house and outsourcing. For example, you could hire an in-house payroll team that will be employed by you and therefore, have a contract of employment. Or you could outsource your payroll to a professional firm that will look after everything from payroll set-up to payroll processing.

- Contract of Service

Individuals are hired as employees and therefore, protected by employment legislation. - Contract for services

Individuals who are independent or self-employed contractors. They are not considered employees and therefore, they may not be protected by employment legislation.

How to pay employees in Ireland?

Register as an employer

Report payroll information to Revenue

File monthly PAYE returns to Revenue

PAYE registration in Ireland

Sole Traders and Limited Companies in Ireland can hire employees to look after certain aspects of your job.

If you are a Sole Trader, you need to personally register. If you are the director of a Limited Company, your company will register as an employer.

The PAYE registration process is the same for both business structures: you need to complete a Tax Registration form and submit it to Revenue. You can also register as an employer online with Revenue Online Service (ROS) or you can outsource this requirement to a professional firm, like Accountant Online.

It’s good to know that if you have not registered as an employer but Revenue suspects that your business should be registered, they can automatically register you. You should also be aware that you do not need to register as an employer if you only have one employee who is paid less than €40 per week.

What is the Revenue Payroll Notification (RPN)?

The Revenue Payroll Notification (RPN) employers of the correct tax credits and the cut-off point for their employees.

Generally, any payroll system will retrieve the necessary RPNs as part of their normal payroll process.

If you don’t use a payroll system, you can obtain RPNs through Revenue’s Online System.

In some cases, employers or payroll specialists are unable to retrieve the necessary RPN and in this case, you must charge emergency tax on your employee’s wages.

1) Income Tax (IT)

The amount of income tax per employee depends on how much they are being paid. Different cut-off points are depending on the employee’s circumstances, such as whether are they single, married or widowed.

Before the income tax rate is calculated, employees are allowed to use tax credits or reliefs to reduce the amount of income that is subject to income tax. It’s important to note that employees need to claim their tax credits and reliefs on their ROS accounts. Check out our guide on how to reduce income tax liability for more information.

In other words, it is the employees’ responsibility to ensure that the correct tax credits are applied to their employment.

Revenue communicates an employee’s tax credits to employers. This is because each employee will have different personal circumstances that affect their income tax rate.

Additionally, being aware of and adhering to the deadlines can help avoid the penalty for late filing of the income tax return.

2) Universal Social Charge (USC)

If an employee’s income is above a certain threshold (€13,000 in 2021), the employer needs to deduct USC from employees’ wages.

There are different rates of USC depending on how much you are paying your employee.

USC rates are allocated to employees through Revenue. Again, it is your employees’ responsibility to tell Revenue about their circumstances.

3) Pay Related Social Insurance (PRSI)

PRSI is used to fund social welfare payments. It’s paid by employees and employers in Ireland. The value of PRSI paid depends on how much you pay each employee.

Each time an employee is paid – they make a ‘PRSI contribution’ and it is deducted from every wage.

PRSI contributions are made up of two payments:

- Employers’ PRSI. The amount of PRSI an employer pays is added to an employer’s PAYE tax liability.

- Employees’ PRSI. The amount of PRSI that an employer deducts from an employee’s wages on behalf of Revenue.

4) Local Property Tax (LPT)

If your employee is the owner of a property, they can choose to pay their LPT at the source of their income (i.e. their job).

An employee can tell Revenue that they wish to pay their LPT at the source and in turn, Revenue will communicate the rate of LPT to deduct from their wage each month.

If you need help with payroll, contact our Client Services Team about our payroll services in Ireland. We’re always happy to discuss your needs and offer the best service for you.

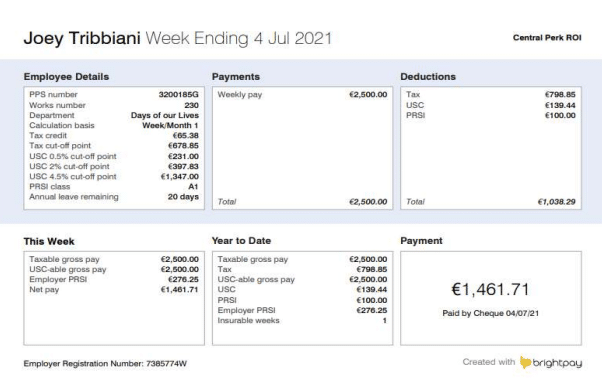

What information is on a payslip?

-

Employee Details

Here you will see your tax credits and cut-off point rates, calculation basis, PPS number, PRSI class, the annual leave taken to date in the calendar year, and the annual leave remaining balance to date.

-

Payment details

This displays the gross amount (before tax and deductions) and usually this is calculated based on the number of hours and the hourly rate of pay. If the employee(s) have an addition such as a bonus, this will appear also here.

-

Deductions details

This is where you will see the amount of tax deducted, tax (pay as you earn), USC (universal social charge) and PRSI (pay related social insurance). Other deductions for your employees, such as saving schemes, will appear here also.

-

This month

In the This Month box, you will find the total taxable gross pay for the employee.

-

Year to Date

Here you will find the total taxable gross pay for the employee from the start of the tax year, the total tax paid, the total USC, total employee PRSI and the total employer PRSI. The number of insurable weeks will also be displayed here.

-

Payment

This is the actual amount of money your employee receives from you. This is labelled as employee take-home pay. Payment method can also be displayed here.

What do employers need to make payroll submissions to Revenue?

-

Employees registered for PAYE in Ireland

Employees need to have Personal Public Service Number (PPSN) and they should be registered for PAYE. If they are not registered, you will not receive their RPN. This means you will need to charge tax on an emergency basis.

-

The amount of gross pay

You should know the employee's gross pay (ie. pay before tax). Holiday pay, overtime, bonuses or commission is also included in gross pay.

-

Revenue Payroll Notification (RPN)

The RPN provides employees with the necessary information to deduct from the employee the correct Income Tax, Universal Charge, and Local Property Tax.

-

Correct employee payment details

Employers need to establish when they pay employees - this is usually weekly or monthly. You should also have their correct bank details to make sure you're paying them securely.

-

Other details to report to Revenue

As an employer, you can operate an approved occupational pension scheme for your employees. If you operate a pension scheme, you need a pension tracing number. You can also offer benefit in kind (BIK) for the medical insurance premium and you’ll need to input the total amount of medical insurance paid by you.

-

Benefit information

For example, company share-based remuneration, taxable benefits, or amounts contributed by employer to retirement schemes should also be communicated to Revenue in a payroll submission.

When do I need to file PAYE returns to Revenue?

Employers are required to file and pay monthly returns for the PAYE tax liability by the 23rd day of the following month if filled online via ROS. For example, January returns are filed and paid by 23 February if you file and pay online.

You could also complete a paper form but you only have until the 14th of the month to file and pay the PAYE liability.

What happens if you don’t file and pay PAYE returns on time?

Sometimes employers forget or don’t know they need to file these returns. Revenue will penalise businesses that don’t comply with the legislation and therefore incur financial consequences on your business.

You could be subject to:

- Interest on late payments of 0.0274% per day the filing and payment is late

- An employer could face a €4,000 fine for each breach of the PAYE rules and where that employer is a company, the Company Secretary of that company shall be liable to a separate penalty of €3,000 in respect of each failure.

Consider outsourcing payroll

-

Peace of mind that your payroll is compliant

Our expert payroll team are always up to date with new Revenue regulations.

-

Save time and focus on other aspects of your business

We'll take care of payroll so you don't have to.

-

Confidence that your employees are being paid correctly

Avoid mistakes in payroll processing by outsourcing to professionals.

-

Greater security than operating payroll in house

Don't worry about your employees finding sensitive information about other employees.

Kiera leads the Bookkeeping, VAT, and Payroll Teams at Accountant Online. Kiera has worked in the financial services industry for over 18 years. She is passionate about helping businesses to get their finances in order so they can get back to what’s important: running your business. Kiera holds a part-qualified accountant qualification from ACCA.